How Construction Influences Florida Homeowners’ Insurance Rates

Florida is renowned for its sunny climate, beautiful beaches, and, unfortunately, its susceptibility to hurricanes and other severe weather conditions. These environmental factors have significant implications for homeowners, particularly regarding insurance costs. According to Florida Insurance Quotes, the home’s construction is one of the most pivotal aspects influencing these insurance rates. From building materials to architectural design, how a house is built in Florida can dramatically affect the premiums homeowners must pay for insurance coverage. This article delves into how home construction impacts Florida homeowners’ insurance rates in the Sunshine State.

The Link Between Home Construction and Florida Homeowners’ Insurance Rates

The relationship between home construction and Florida homeowners’ insurance rates is deeply interconnected, particularly in regions prone to natural disasters. Insurers assess the risk associated with a property before determining premiums, and the home’s construction is a critical factor in this evaluation. Homes built with modern, high-quality materials and techniques are usually deemed safer and less likely to incur significant damage during a storm. As a result, these homes typically attract lower insurance premiums compared to older structures that may not meet current safety standards.

Furthermore, the age of the home plays a crucial role. Builders often construct older homes with materials and methods that do not comply with current building codes, making them more vulnerable to damage. This increased risk translates to higher insurance premiums. In contrast, newly constructed homes that adhere to contemporary building codes are generally viewed as less risky, reducing insurance coverage costs.

Another important consideration is the home’s structural design. For instance, homes with complex roof shapes may face higher insurance rates due to the increased likelihood of wind damage. More straightforward, aerodynamic shapes are preferable as they can better withstand high winds, thus lowering the risk and the associated insurance costs.

Lastly, localized factors such as the home’s proximity to the coast or flood zones influence insurance premiums. Coastal homes, for example, are at a higher risk of hurricane damage, necessitating more expensive insurance policies. Meanwhile, inland homes built with flood-resistant features can benefit from reduced insurance rates, emphasizing the importance of construction features tailored to specific environmental risks.

Florida’s Unique Construction Standards and Regulations

Florida has implemented stringent construction standards and regulations to mitigate the risks of hurricanes and other severe weather conditions. These regulations, known as the Florida Building Code (FBC), are among the most rigorous in the United States and aim to enhance the durability and safety of residential structures.

One of the FBC’s critical components is its focus on wind resistance. The code mandates that contractors build homes in hurricane-prone areas to withstand winds up to 140 mph or more, depending on their location. Compliance with these standards not only ensures the safety of occupants but also significantly influences insurance premiums. Homes built to meet or exceed these requirements are perceived as lower risk, leading to reduced insurance costs.

Additionally, the FBC includes provisions for impact-resistant windows and doors. These features prevent flying debris from breaching the building envelope during a storm, minimizing interior damage. Homes with such protective measures are more likely to receive favorable Florida homeowners’ insurance rates as the risk of costly repairs diminishes.

The FBC also emphasizes proper roof construction techniques. Roofs must be securely fastened to the building structure to prevent uplift during high winds. Enhanced features such as secondary water barriers and reinforced connections are encouraged. Homes adhering to these guidelines are less prone to severe damage, which insurers recognize through lower premium rates.

Finally, the Florida Building Code is regularly updated to incorporate the latest advancements in construction technology and safety research. These periodic updates ensure that new homes are consistently built to the highest safety standards, further influencing insurance rates by continually reducing the risks associated with homeownership in Florida’s challenging climate.

Impact of Building Materials on Florida Homeowners’ Insurance Rates

The choice of building materials is a significant factor in determining home insurance premiums in Florida. Insurers evaluate various materials for their durability, resistance to weather-related damage, and overall contribution to the home’s structural integrity.

Florida home insurance companies prefer concrete and masonry due to their robustness and resistance to wind and water damage. Homes constructed with these materials are generally considered safer and less likely to suffer catastrophic damage during hurricanes. Consequently, such homes attract lower insurance premiums than those built with less durable materials like wood.

On the other hand, while aesthetically pleasing and often less expensive to construct, wooden structures pose higher risks during severe weather events. Wood is susceptible to rot and termites and, more importantly, can easily be damaged by flying debris. Insurance companies factor in these vulnerabilities when calculating premiums, often resulting in higher costs for homeowners with wooden houses.

In addition to the primary structural materials, the quality and type of roofing materials also play a crucial role. Metal roofs, for example, are highly durable and offer excellent resistance to wind and hail, making them a favorable option for reducing insurance premiums. Conversely, while common and cost-effective, shingle roofs may not provide the same level of protection, leading to higher insurance rates due to their propensity for damage in severe weather conditions.

Furthermore, using sustainable and fire-resistant materials can also impact insurance premiums. Homes incorporating eco-friendly and fire-resistant options such as fiber-cement siding or treated wood contribute to environmental sustainability and enhance safety, potentially lowering insurance costs. Insurers reward these proactive choices with more competitive premium rates, recognizing the reduced risk they represent.

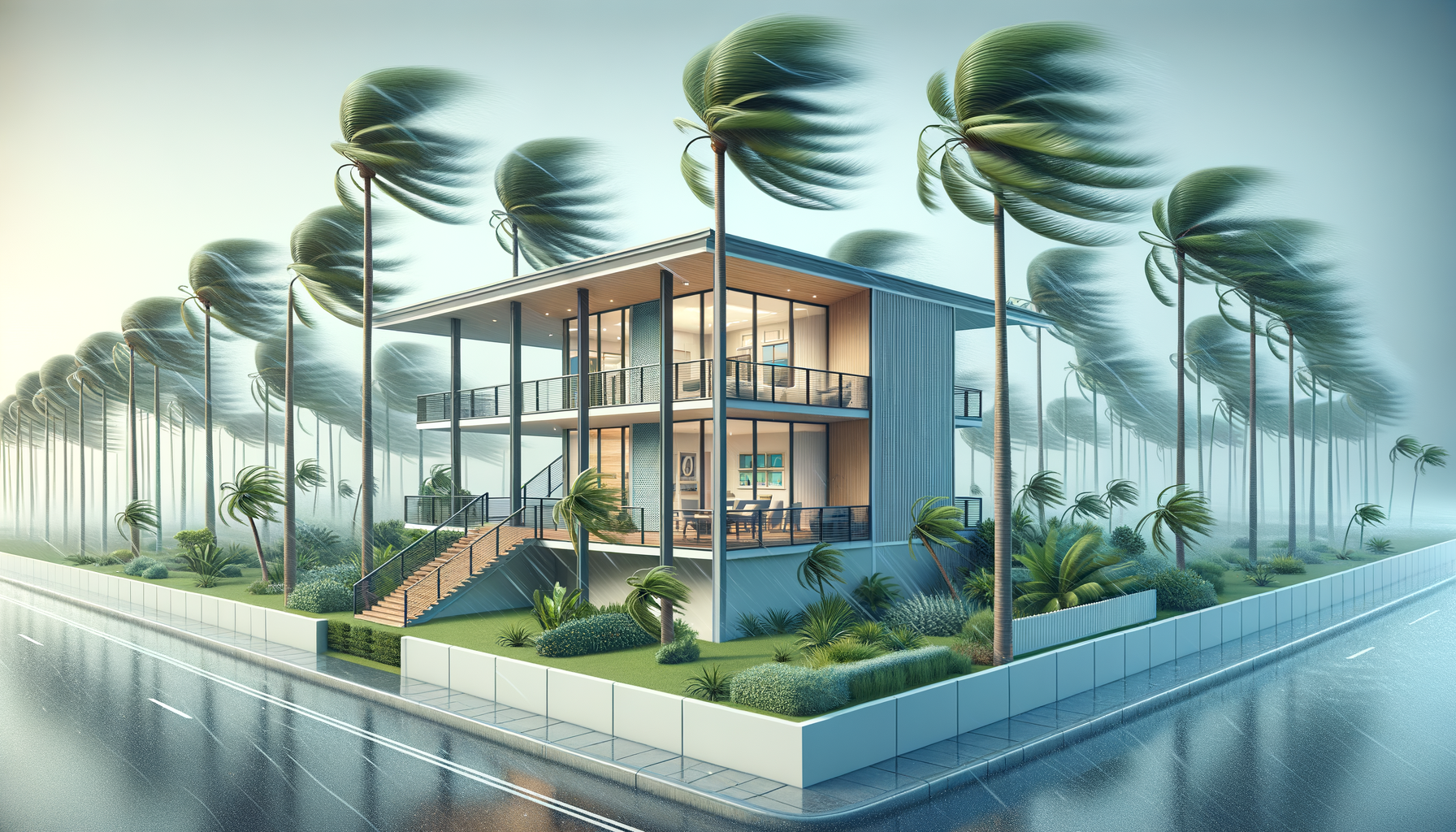

The Role of Hurricane-Resistant Designs in Cost Reduction

Hurricane-resistant designs are pivotal in mitigating the impact of severe weather, thereby reducing Florida homeowners’ insurance premiums. These designs incorporate architectural and structural elements to enhance homes’ resilience to hurricane-force winds and associated hazards.

One of the most critical aspects of hurricane-resistant design is the roof structure. Engineers design roofs to withstand high winds through hip roof construction, which has a lower wind profile than gable roofs. Techniques like installing hurricane straps, which secure the roof to the walls, are crucial in preventing roof uplift during a storm. Homes built with these features are often eligible for significant discounts on insurance premiums due to their enhanced durability.

Windows and doors are also integral components of hurricane-resistant design. Manufacturers construct Impact-resistant windows and doors with materials that can withstand the force of flying debris, reducing the risk of breakage and interior damage. Insurance companies highly value these protective features, leading to lower premiums for homes equipped with such safety measures.

Another essential element is the elevation of homes in flood-prone areas. Elevated designs, including stilts or raised foundations, help prevent floodwaters from entering the living spaces. This reinforcement is particularly relevant in coastal regions of Florida, where flooding is a significant risk. Elevated homes are less likely to suffer extensive damage during floods, reducing insurance premiums.

Finally, incorporating hurricane shutters or protective screens for windows and doors further enhances a home’s resistance to storm damage. These additional layers of protection can significantly reduce the extent of wind and water damage. Insurance companies often offer premium discounts for homes equipped with these features, recognizing the lowered risk of severe damage during hurricanes.

Conclusion

In conclusion, the construction of a home is critical in determining Florida homeowners’ insurance rates. By adhering to stringent building codes, utilizing durable materials, and incorporating hurricane-resistant designs, homeowners can significantly reduce their insurance premiums. The Florida Building Code and modern construction techniques are designed to enhance the safety and resilience of homes, ultimately benefiting both homeowners and insurers. As climate change continues to influence weather patterns, the importance of robust home construction and its impact on insurance rates is likely to grow even more pronounced, making it a key consideration for current and future homeowners in the Sunshine State.